Municipal Contributions and the Schedule Form

The Office of the State Auditor (OSA) regularly receives questions about municipal contributions and when they must be paid to a relief association.

For defined-benefit monthly and monthly/lump-sum plans, municipal contribution requirements are based on the most recent actuarial valuation. These relief associations must determine the minimum obligation of the municipality for the upcoming calendar year and must certify the financial requirements and minimum obligation to the municipal governing body by August 1 of each year. The OSA does not require that a specific form be used to make the certification. Relief association trustees usually work with their actuary to prepare the certification. Additional information about municipal contribution requirements for relief associations that pay monthly benefits can be found in the OSA’s Statement of Position on this topic.

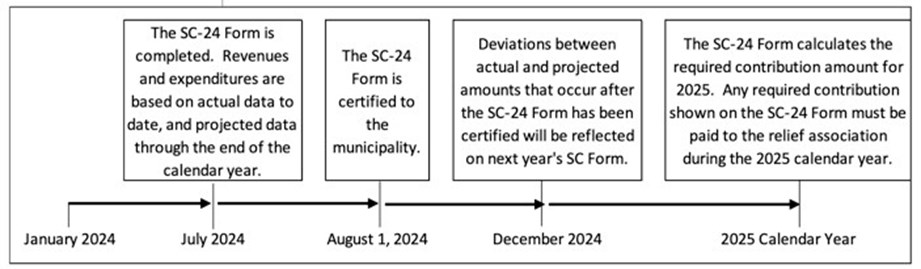

For defined-benefit lump-sum plans, municipal contribution requirements are calculated each year using the Schedule Form. Relief associations are to complete the Schedule Form during the month of July, and must certify the Form to the affiliated municipality by August 1. If the relief association is affiliated with an independent nonprofit firefighting corporation rather than a city or town fire department, the Form should be certified to the independent board.

Because the Schedule Form is completed in July, and is required to be certified by August 1, revenue and expenditure amounts for the year must be projections made based on the available mid-year information. In July, relief associations should determine their investment returns to date, as well as revenues received and expenses paid. Based on this actual experience, the relief association should project investment, revenue, and expense amounts that seem reasonable for the remaining portion of the year. Many relief associations work with their investment advisors, brokers, and auditors when making these projections.

The Schedule Form is intended to provide estimates of a relief association’s assets and liabilities, and to calculate contribution requirements based on those estimates. Revenue and expenditure amounts that are projected on the Schedule Form will differ from the final year-end amounts. The Schedule Form is completed annually, so any deviations between projected amounts and the actual year-end amounts will be reflected on the next year’s Form. Relief associations should not make changes to the projections after the Schedule Form has been certified.

Note that sometimes, a relief association with a surplus may find that a contribution is required for the upcoming calendar year. This is because the amount of state aid projected to be received is not enough to cover the expected cost of members accruing another year of service credit and expected expenses. A contribution is needed to help cover the projected gap in revenue.

Generally, relief associations are required to obtain ratification from the affiliated municipality or independent nonprofit firefighting corporation of a benefit level change before the change becomes effective. There is authority, if certain conditions are met, for a relief association to increase its benefit level without obtaining ratification.

There is a risk if a relief association decides to increase benefits on its own. If the benefit level is increased without ratification and a municipal contribution subsequently becomes required, the benefit level is no longer effective without ratification and any future benefits can only be paid using the ratified benefit level (i.e., the relief association must lower its benefit level to the last ratified level.)

There currently are a handful of relief associations operating at unratified benefit levels. If your relief association is in this position and has questions about the possibility of needing to lower its benefit level, please contact Pension Division staff for assistance.

The chart below shows when the 2024 Schedule Form (SC-24) is to be completed and certified, and when any required contributions must be paid.

Published last in the March 2024 Pension Newsletter