"Excess TIF" Is Not Tax Increment

On tax settlement reports (as in the sample below), counties might identify “excess TIF” or some similar term. This likely refers to distributions of “excess taxes,” or could possibly refer to redistributions of returned “excess increment” or other returned tax increment. These amounts are not tax increment and should not be reported as such.

Excess taxes are generated in the course of tax increment computations but are not tax increments. They are generated when the local tax rate exceeds the original local tax rate of a TIF district. The tax generated by the difference in these rates is “excess tax”. TIF law excludes it from tax increment under the idea that increment should be generated by growth in value, not increases in tax rates. The county auditor distributes excess taxes to the county, municipality, and/or school district based on which jurisdiction(s) caused the excess. These amounts are general tax dollars over and above what the jurisdiction levied.

Generally, “excess increments” are tax increments that exceed costs authorized in the TIF plan. They are calculated each year on the TIF Annual Reporting Form. Excess increments must generally be returned by September 30 of the following year to the county auditor, who redistributes them to the county, municipality and school district in proportion to their tax rates. The redistributions are no longer tax increment and become general tax dollars over and above what the jurisdiction levied.

Tax increment may also be returned for other reasons (as unneeded, “surplus” increment, or as violation repayments), and such redistributions also become general tax dollars over and above what was levied.

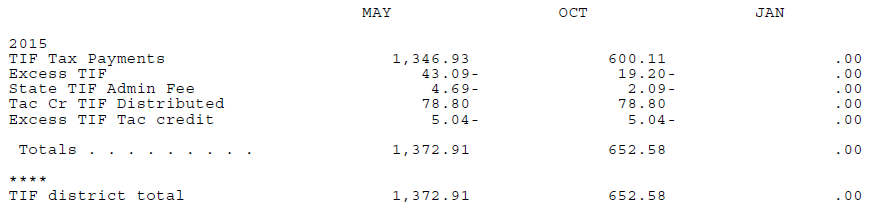

When completing TIF Annual Reporting Forms, do not include these amounts as increment. Also, ignore amounts labeled as “TIF enforcement deductions” or “state TIF admin fees.” These labels refer to amounts deducted from distributions and sent to the State for OSA oversight. (Note: Do include credit distributions labeled as “TIF” as TIF credit revenues on reporting forms, except those labeled as excess TIF credits.)

Sample tax settlement report (formats vary):

Last referenced June 25, 2021 in the State Auditor's E-Update.